The finance landscape is evolving at record speed. Siloed data and manual entry are becoming a distant memory. Forward-thinking finance teams are embracing a new era of FP&A, powered by cutting-edge technology. These tools automate tasks, streamline processes, and unlock game-changing insights, enabling finance to become a strategic partner in driving business success.

That's where accounting software and ERP add-ons come in – these specialized tools supercharge your existing ERP system, taking your finance function from "spreadsheet hell" to a strategic powerhouse.

In 2024, we're witnessing a surge in automation across the finance tech stack.

If your business runs on Sage Intacct, Sage 300, Oracle NetSuite, Microsoft Dynamics, QuickBooks Online, Xero, Epicor, or any other ERP, here's a breakdown of some key areas where add-ons are revolutionizing finance functions:

- FP&A Software: Transforming Planning & Analysis

Challenge: Traditional planning processes can be cumbersome and time-consuming, often relying on spreadsheets and manual data manipulation.

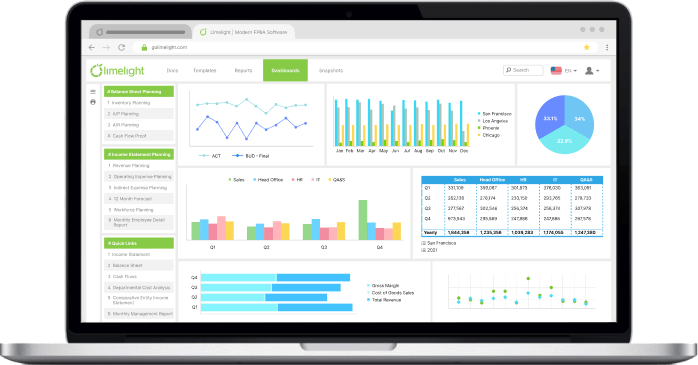

Solution: Limelight Software and Prophix

Overview: Limelight and Prophix are budgeting applications that empower finance teams with features like flexible budgeting, scenario modeling, and real-time adjustments. These features, along with dynamic filters and centralized calculations, streamline analysis and ensure data accuracy.

- Close Management Software: Streamlining Month-End Close

Challenge: Month-end close can be a chaotic and stressful time for finance teams, riddled with manual reconciliations and errors.

Solutions: Blackline and FloQast

Overview: Blackline and FloQast automate tasks like reconciliations, account matching, and task management. These tools improve efficiency, reduce errors, and allow teams to close the books faster.

- Business Intelligence (BI) Software: Unlocking Data Insights

Challenge: Modern ERPs generate vast amounts of data, but extracting meaningful insights can be challenging.

Overview: Power BI, and Domo provide user-friendly dashboards, visualizations, and reporting tools. Finance teams can easily analyze trends, identify performance gaps, and make data-driven decisions.

- Accounts Payable (AP) Automation: Simplifying Invoice Management

Challenge: Managing invoices can be a time-consuming and error-prone process. Paper invoices require manual processing, while electronic invoices can be scattered across various systems.

Solutions: Bill.com, Yooz, and Tipalti

Overview: These tools streamline invoice capture, approval workflows, and payments. These tools improve efficiency, reduce costs, and enhance visibility into payables.

- Accounts Receivable (AR) Automation: Optimizing Cash Flow

Challenge: Collecting payments from customers can be slow and inefficient, leading to cash flow issues.

Solutions: HighRadius, Versapay, and BlueSnap

Overview: These applications automate tasks like sending invoices, collecting payments, and managing disputes. These tools improve collection rates, reduce delinquencies, and ensure a smoother AR process.

- Spend Management: Gaining Control Over Expenses

Challenge: Managing employee expenses can be complex, with paper receipts and manual reporting leading to errors and inefficiencies.

Solutions: Expensify, Corpay, and Emburse

Overview: These tools simplify expense tracking and approvals. These tools offer features like mobile receipt capture, automated reports, and corporate card integration, leading to increased visibility and control over spending.

Choosing the Right Add-Ons for Your Business

The ideal add-on landscape will vary depending on your specific needs and budget. Here are some key factors to consider when making your selection:

- Identify your pain points: What are your finance team's biggest challenges? Choose add-ons that directly address those issues.

- Integration with your ERP: Ensure the add-on seamlessly integrates with your existing ERP system to avoid data silos and manual workarounds.

- Scalability and Security: Consider the future growth of your business and choose add-ons that can scale with your needs. Security should also be a top priority – ensure the add-ons offer robust security features and certifications to protect your financial data.

By embracing the power of add-ons, finance teams can unlock a new level of efficiency, accuracy, and data-driven decision-making. Exploring solutions that address your specific challenges will allow you to build a robust and automated finance tech stack, enabling your team to focus on strategic initiatives and drive business success.