We’ve worked with finance teams from all industries, and have seen customers dealing with countless error-prone, time-consuming and outdated spreadsheets in Excel.

It’s nearly impossible to get a holistic view of your business using spreadsheets for your budgeting, forecasting and reporting. Poor visibility into your operations creates more risk and leaves you vulnerable to making decisions with incomplete data.

The cons of using static spreadsheets include significant time spent performing manual input, poor data management and no integration with source systems, making real value-added planning hard to achieve.

To keep up with the growing amount of data used in finance every day, executives need a system that can cut down on manual labor and deliver critical information in real-time. Here are the top 10 reasons why digital finance teams are choosing to replace Excel with a more modern solution: Cloud FP&A software.

1. Integration to Source Systems

.webp?width=450&name=ERP%20parent%20page%20thumbnail%20(1).webp)

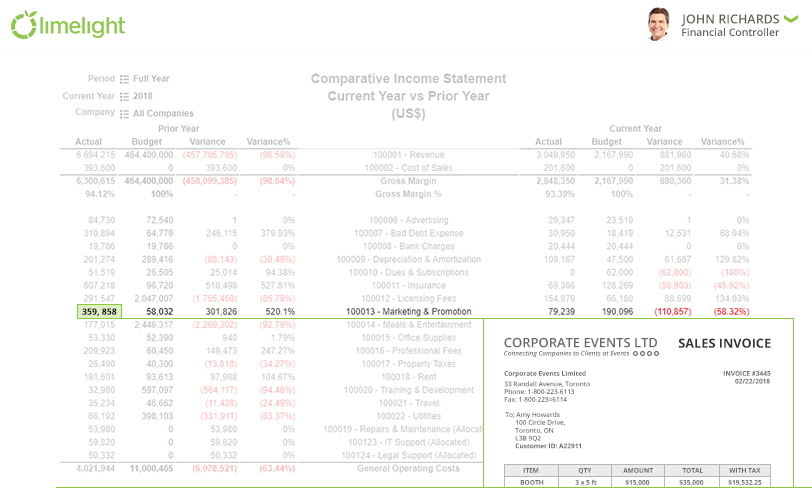

Your company’s source systems, particularly your GL, need to integrate with your Excel models in order to achieve comprehensive planning.

For example, a rolling forecast showing 3 months of actuals and 9 months of planning needs baseline data to pre-populate the model. Finance teams will often either enter data manually or create their own integration through VLOOKUPs or data dumps from their source systems. These methods are time-consuming and also increase the risk of errors.

Cloud FP&A solutions generally provide the ability to integrate with several source systems, allowing data to flow seamlessly into budgets and reports. Data refreshes can be performed on-demand, so executives have instant access to insights.

2. No More Error-Prone Spreadsheets

.webp?width=450&name=spreadsheeterror%20(1).webp)

Error-prone spreadsheets are a recurring problem that takes up a significant amount of time for finance teams. As long as the input remains manual, human errors are bound to occur. Not to mention, sending emails back and forth between colleagues and reconciling different versions of the same spreadsheet creates ample opportunity for errors.

Using automation from Cloud FP&A software, teams no longer have to worry about inputting data themselves and causing errors. Nor will they be at risk of broken formulas or templates. The data presented in their reports is accurate and up-to-date, eliminating the need for constant checks and balances.

3. Access to Real-time Insights

.webp?width=450&name=tourthumb_02%20(1).webp)

Have you ever sat waiting for Excel workbooks to save or recalculate? Or waiting on a team member to input the data needed to complete the budget cycle? Tracking down information across a business is tedious and no finance professional wants to be stuck waiting on others to complete their own work.

With a Cloud FP&A solution, calculations are done in real-time throughout the model, regardless of the number of calculations or dependencies. Integrating with Cloud FP&A software offers finance teams a performance boost for faster, more efficient reporting. A study by The American Productivity & Quality Center (APQC) found that time spent on planning cycles and the close process had been reduced by 70% and 50% respectively when finance teams implemented Cloud FP&A software.

4. Data Unification and “One Version of Truth”

.webp?width=450&name=tourthumb_02%20(1).webp)

A business could have hundreds of spreadsheets across different departments, and each of those spreadsheets can contain multiple worksheets. Unifying these spreadsheets to produce one corporate budget can be exceedingly laborious, especially with the added problem of varying formats.

When you integrate a Cloud FP&A system, your corporate finance team will have access to automated management reporting and analytics through a single source. This unified system makes it easy to modify finance processes to keep up with the ongoing changes in the business. Also, the total cost to your business will be lower if you have one system performing everything, rather than separate systems that require additional training, time, and high implementation costs.

5. Better Collaboration

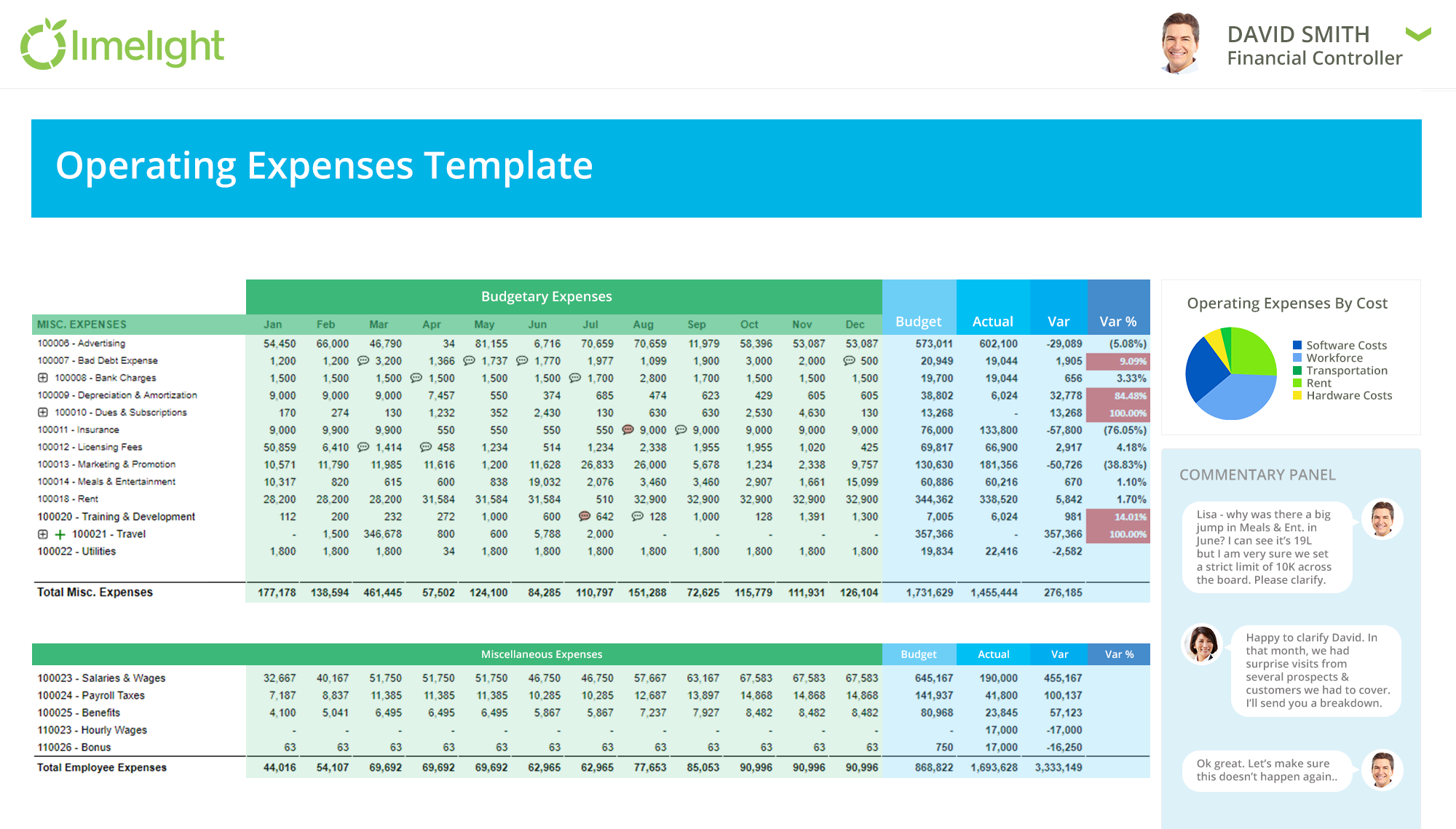

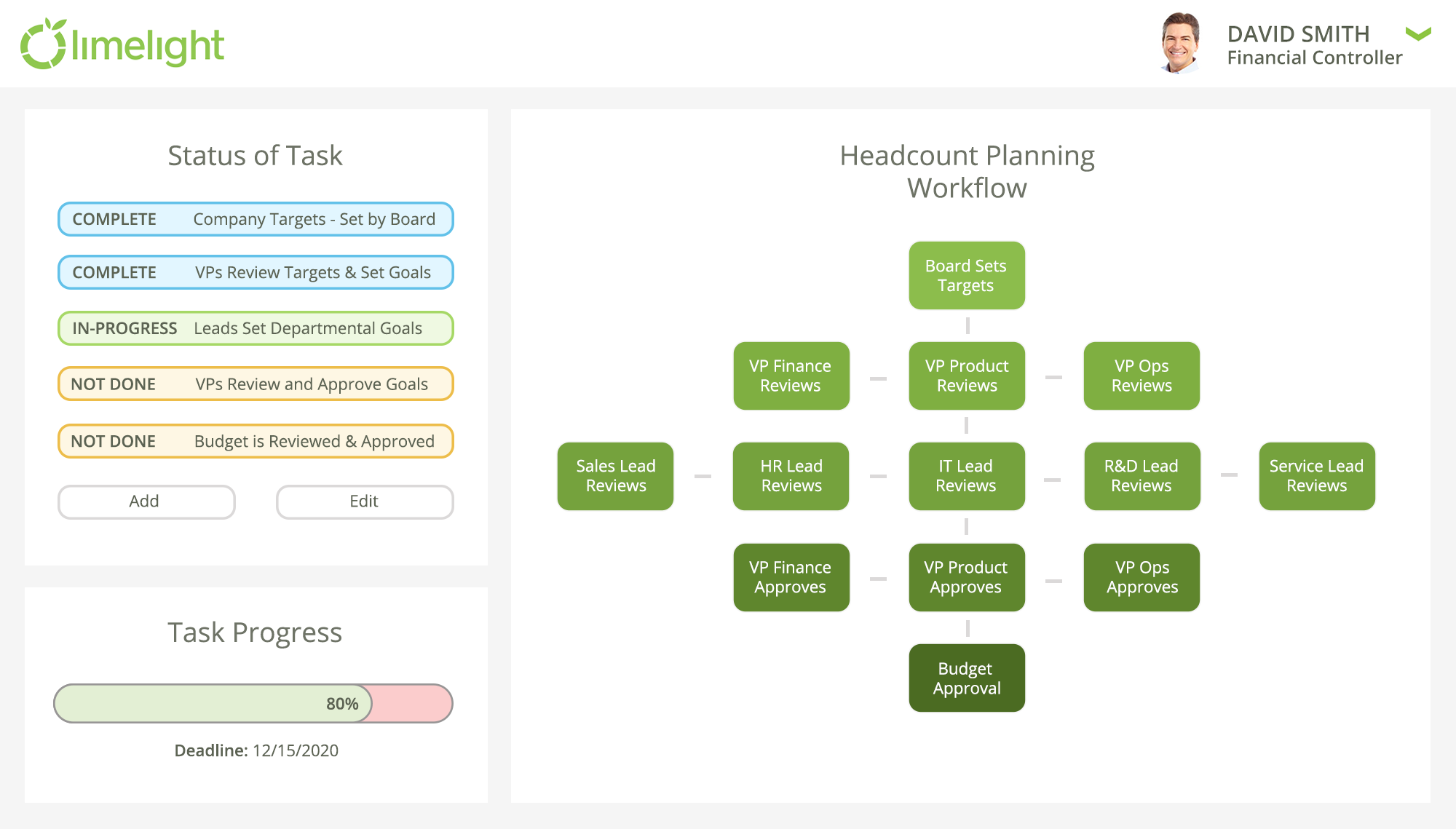

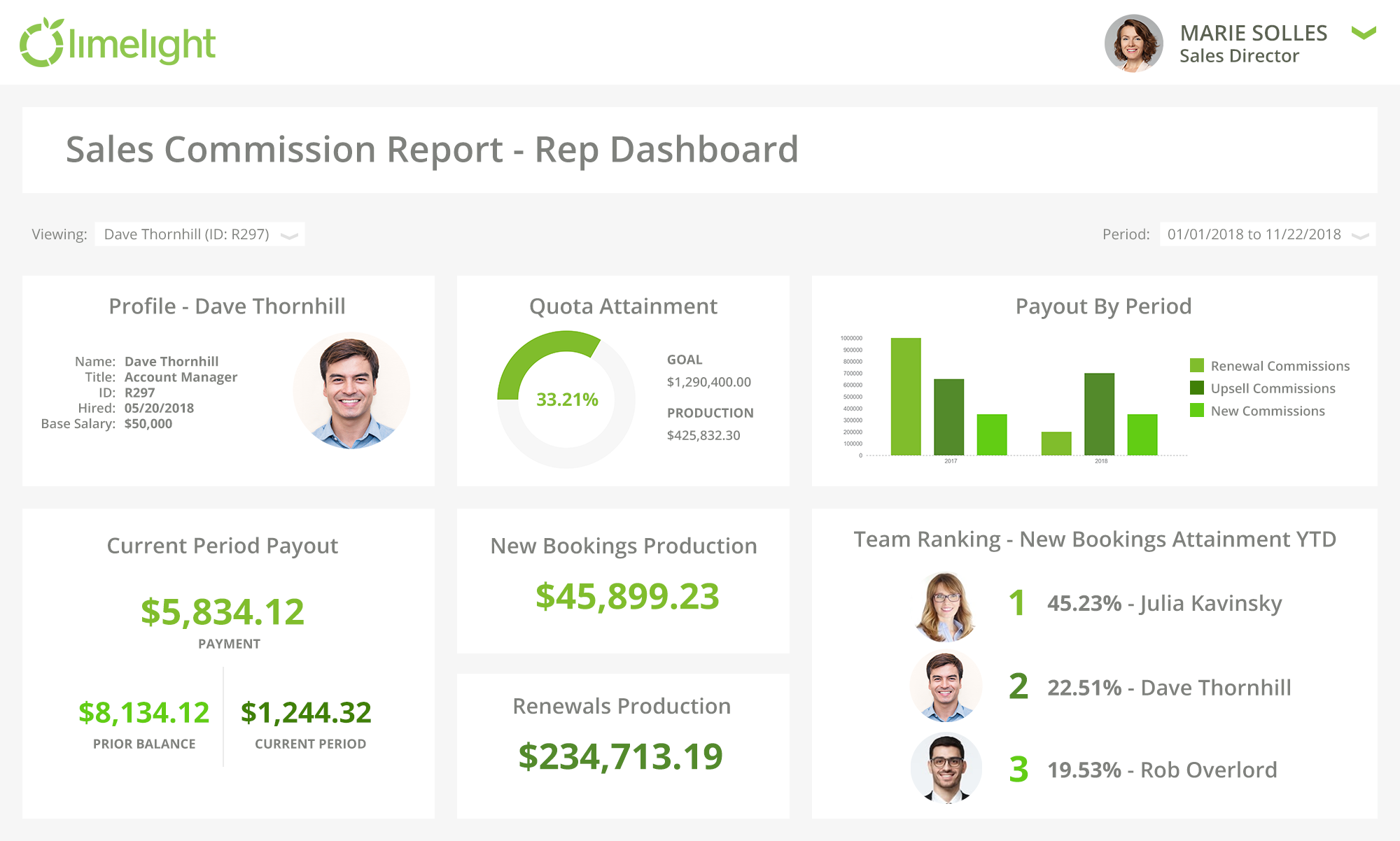

Excel only allows for single access use, forcing users to copy models and distribute them via email before being consolidated. Planning is more powerful when various team members can access workspaces at the same time and share the same models. This way, managers can always work with the most up-to-date numbers and do not have to track down the most recent and accurate version of reports.

Excel also does not offer insights into what your team is currently working on. If you’ve emailed worksheets out to cost centers to be completed, you cannot see which teams have started, which teams are waiting on other contributors, and which teams have completed the worksheet but have not sent it back to you.

A Cloud FP&A solution enables the creation of workflows to manage contributors, strict deadlines, and many iterations. You’ll have visibility into the entire planning process with a snapshot of who has not started, who is in progress, and who has already submitted their work.

6. Increased Visibility and Control

In larger organizations where many people are involved in the budgeting and forecasting process, it is challenging to see what changes are being made in real-time. Visibility and control over your workbooks are crucial to increasing productivity.

Say, for example, a number changed on the budget or forecast. In Excel, you’d have to scramble in various files and try to trace formulas to get to the source of the problem. Excel offers no way of seeing when the number was changed nor who changed it. The only visibility you have is a date and time stamp of when the entire worksheet was last updated.

A Cloud FP&A solution can track who made what change, when it was made and what data was previously there. Most FP&A software stores a history of changes so you can look back to see prior versions. The solution also enables teams to lock versions to eliminate the risk of accidental or last-minute changes.

7. More Time for Data Analysis

In Excel models, creating a new version of your plan can be extremely strenuous, especially if you have multiple linked sheets and workbooks. And once you have put in the effort to create a few versions, comparing them is not a simple task, as key metrics are likely to be spread across several workbooks.

With a Cloud FP&A solution, finance teams can create new versions in seconds, enabling them to run different scenarios, tweak business drivers and optimize their plans. Comparing multiple scenarios is easy, and users don’t have to worry about unintentionally breaking or changing any formulas. Teams no longer have to spend the majority of their time building a model from scratch and can instead focus on analyzing business performance.

8. Enhanced Security

Distributing Excel files via email can be detrimental to security. If files with sensitive data end up in the wrong hands, the impact could be significant and costly.

A Cloud FP&A solution not only allows users to collaborate on the same models simultaneously but can also enable enhanced security measures. Users can only access models and departments they manage, which helps ensure that users are not changing numbers provided by corporate.

9. Standardization

One challenge that finance teams rarely think about is standardization. Reports are being created on-the-fly and methodologies can change from person to person in each role. If the method changes, then it becomes difficult to perform proper comparisons over time.

One challenge that finance teams rarely think about is standardization. Reports are being created on-the-fly and methodologies can change from person to person in each role. If the method changes, then it becomes difficult to perform proper comparisons over time.

Implementing Cloud FP&A software opens up the opportunity to standardize your budgeting, forecasting, and reporting. Every finance professional works with the same templates and calculations, allowing reports to easily roll up into one consolidated view of the company.

10. More Affordable and Quick to Deploy

The manual labor of creating and managing spreadsheets consumes both time and money. The AQPC survey found that companies that spent more on FP&A technology could reduce the number of days it takes to complete their budgeting cycle. With less time being spent on gathering data and managing spreadsheets, teams were able to fully benefit from FP&A software.

Most modern FP&A solutions are available on the cloud or as SaaS-based applications. The subscription cost typically includes the software, support and maintenance, and upgrades. The software does not require IT to run and can be owned by finance users. This means fewer additional resources spent on implementation, immediate access to a complete solution, and seamless integrations that require little input from IT departments.

Next Steps: Making the Switch to Cloud FP&A

With Cloud FP&A software, you can discover more opportunities for better budgeting, forecasting, and reporting. Planning is accurate, flexible, and fast, giving finance teams the freedom to perform deeper analysis for strategic business decisions.

This blog post gives a glimpse into the problems Cloud FP&A software solves for finance teams still using Excel. If you would like to know the must-have features in a Cloud FP&A vendor, check out our complete evaluation checklist.