More and more CFOs and finance leaders are acknowledging that today’s business environment requires agility in planning to account for unplanned disruptions. Rolling forecasts make budgeting a dynamic process that can better reflect ongoing events instead of something that is rigid and set in stone. When combined with driver-based planning it can help organizations get better, more focused insights from their financial data. Here is a guide to implementing rolling forecasts and driver-based planning to re-vamp your budgeting process and increase the agility and durability of your business.

Step 1: Set a Standard for Accuracy & Speed with Automation

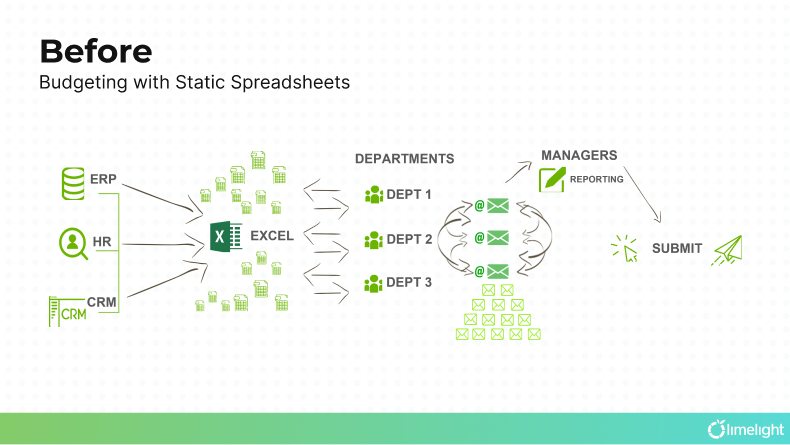

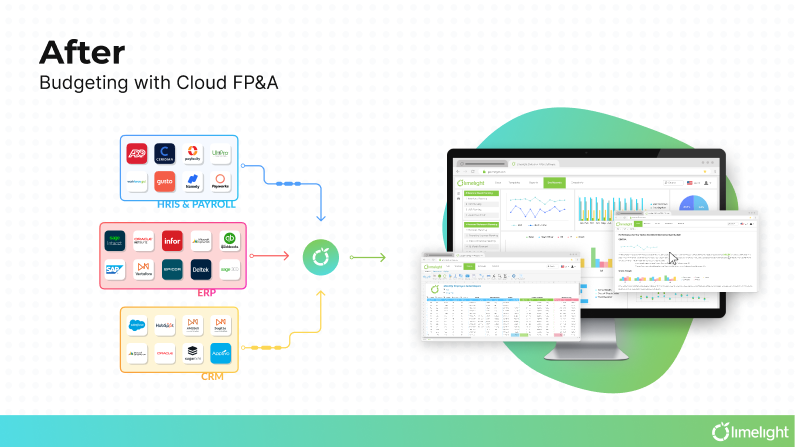

Before one can address rolling forecasts, organizations should start by seriously looking at how they gather the data that informs their budgeting and planning. Most financial teams rely on manual data entry coupled with a static spreadsheet program to perform the bulk of their financial planning. This approach has the benefit of familiarity and standardization but is unfortunately prone to manual errors. Manual errors in turn cause cascading effects that can throw off your entire analysis and leave you in an uncertain position. Studies have shown, additionally, that a large portion of the manual tasks undertaken by finance teams can be automated instead, which can cut down on potential manual errors that can cause cascading and devastating effects. Automation sets a standard for accuracy and speed across the entire organization that elevates the entire financial process, not just for rolling forecasts.

Step 2: Embed Driver-Based Planning to See the Impact on Business Performance

Originally inspired by baseball analytics, driver-based planning has since entered the business world as an innovative and fresh way to plan without excessive guesswork. In the early 2000s, the cash-strapped Oakland Athletics baseball team used driver-based planning to determine which aspects of a player’s performance were driving results rather than looking at their performance in total.1 By doing this they improved their performance and revolutionized how baseball players are analyzed and their results quickly bled over into the world of high finance.

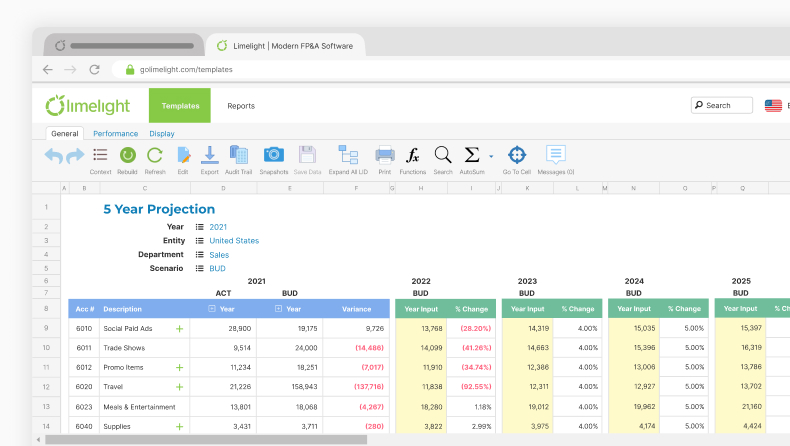

Driver-based planning allows finance teams to isolate key business drivers and see their impact on performance instead of relying on aggregated percentages. Rolling forecasts help you isolate these drivers and can be helpful in using them for strategic plans. Factors like price changes can be explored using what-if scenarios that can measure their impact on all aspects of your business.

Step 3: Transition from Reactive to Proactive Budgeting

Traditional budgeting prepares an annual budget and then analyzes any potential variances at the end of the budgeted period. In the end, the finance department highlights significant variances and digs deeper to understand the underlying trends that are affecting your numbers and causing variances between budgets and actuals.

In contrast, rolling forecasts use various inputs to perform the variance analysis at the beginning rather than at the end of the fiscal year, so teams can prepare for disruptions before they happen. Throughout the year, assumptions that prove to be false can be adjusted, turning budgets into living documents rather than static portraits.

The world is complicated, disruptions occur, and static budgets should no longer be the only tool finance teams employ in a world where things can change overnight. Rolling forecasts can free your organization from reactive thinking and can let you navigate this world as changes happen, rather than in retrospect.

Conclusion

Critics of rolling forecasts often cite its inability to clean up data siloes and other impediments to the planning process. These impediments can be addressed, however, with certain programs that fix structural issues like data siloes by establishing an organization-wide single source of truth so everyone can work with the same information.

Granular details in budgeting are also a significant reason why people might be hesitant about switching, many older platforms do not have the level of detail available in order to perform complex calculations such as rolling forecasts, driver-based planning, and more. Again, modern technology has arrived at the point where that level of granular detail is possible through modern data structuring.

Switching to a more agile budgeting process can help your organization deal with disruptions in a more proactive way and save you time and money. (See how we helped Connecticut Green Bank to transform its budgeting process.) While there have historically been technical factors that have held companies back from agile planning, those technical shortcomings have largely been resolved by new advances in Cloud technology and data science.

Notes: