.webp?width=450&name=Madonna%20Dennis_Author%20Bio%20and%20Pic%20-%20Big%20(1).webp) During any major business disruption, owners must be able to see ahead for the long term and make decisions on what action to take next. As well, it is imperative that business executives be able to reassess decisions as situations unfold. Meaning, their view, and plans need to be dynamic.

During any major business disruption, owners must be able to see ahead for the long term and make decisions on what action to take next. As well, it is imperative that business executives be able to reassess decisions as situations unfold. Meaning, their view, and plans need to be dynamic.

However, many finance executives are finding that the tools they previously relied on are now too slow, too complex, and too disconnected. As such, businesses are finding that they cannot quickly factor in new data points and external factors into their forecasts.

Adaptability is crucial to success, and financial forecasting is key to being prepared for different scenarios. By modeling how the pandemic may impact their business, CFOs and finance executives can help manage their teams and place the company in a stronger position during and after the crisis.

How financial forecasting and scenario planning can help

Let’s first take a look at the definitions of financial forecasting and scenario planning.

Let’s first take a look at the definitions of financial forecasting and scenario planning.

Financial forecasting can show a full picture of a business’s future and help owners make strategic decisions according to best-case, worst-case, and anything in between. Forecasting uses historical data, as well as market and economic conditions, as a basis to predict future outcomes and inform teams of their best course of action.

Scenario planning is a very important forecasting prospect. Businesses can use scenario planning to build forecasts to evaluate the potential impact of the pandemic. To stay in operation during this time, action plans will need to be developed based on various outcomes seen during financial forecasting.

To set clear strategies and get stakeholders on board, CFOs must be able to quickly and accurately see their operations and all departments. Forecasting shows where to cut costs and invest money. But the more time you spend manually gathering all of this data, the fewer time teams have to analyze the data and forge a clear path ahead.

Common challenges for finance teams

Typically, the process for forecasting is so time-consuming that many businesses only forecast at the end of each quarter, or even twice a year.

Part of the problem is that forecasts can change several times as opposed to a budget. As actuals come in from your ERP and HRIS systems, your forecast will likely change.

Depending on the frequency of your forecasts, whether monthly, quarterly, semi-annually, and the type of forecasting you do, there is a lot of work involved to re-forecast each time. Exporting data from multiple sources, consolidating it in Excel, analyzing it, pushing it back into ERPs for reports, and finally sharing the reports takes up a significant portion of the finance team’s time and resources.

During a fast-changing time, businesses cannot be slowed down by their forecasting process. When using Excel to manually model scenarios and forecasts, teams often fall into a cycle of constantly aggregating data. This process uses a lot of manpower that could otherwise be spent on analyzing the forecast. Add in the increased pressure to re-forecast cash flows and scenario analysis from internal and external stakeholders, and finance executives have a tough job on their hands.

Does your business have sufficient information to enable your sales and operations teams to make intelligent decisions? Ensuring your forecasting tools can accurately capture scenarios incorporating fixed and variable costs will help keep your business in good shape.

As well, your forecasting tool should have the ability to handle robust assumptions and various drivers to communicate the expected impact of COVID-19. The forecasting process can be automated using modern tools such as Limelight, allowing teams to set aside time to make smarter, data-driven decisions.

How to get started

Review your long-term strategy and define what you want your business to look like once the pandemic has passed. You may also want to think about how your competitors will react and what their plans are for the future.

When building a forecast, it is best to have software that eliminates manual calculations and modeling. This way you will be able to focus on your inputs and let the software do the tedious work. You also want the software to quickly model several financial scenarios and produce any statements you may need during this time, such as financial statements for a loan.

We recommend Limelight because of its ability to directly integrate with your ERP and automatically pull in data for you. Finance teams need to perform a quick assessment of their current state. Limelight can help businesses leverage data and analytics to make intelligent decisions, supported by a solid forecast.

Update business plans and forecasts with external sources

Your forecast should include external data points to see the full impact on operations. Do your best to collect data on COVID-19, and what strategies economies and businesses around the world have been implementing. From there, finance teams can develop a better sense of which information is a significant driver for their business.

Finance teams can then use this model to determine the impact on their business. The more the impact is broken down-- such as by product line, client, and geographic location-- the better prepared the business will be to make decisions on cash flow, staffing, and funding for projects. By bringing in external resources, the business will have access to more reliable results.

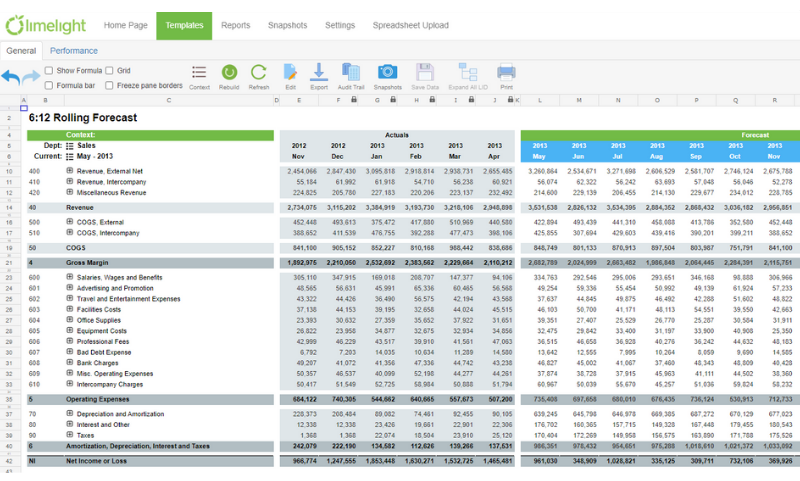

As you add in more resources, your financial forecast should update dynamically. Your cash flow statement should change automatically, to give you an up-to-date view of your business’ cash. When using Limelight, finance teams can utilize rolling forecasts, where actuals and the forecast are updated on a continuous basis. This gives teams a more accurate overview of where the business is headed in the next year.

Refine and automate the forecasting process

Many CFOs and finance teams will find that their forecasting capabilities will expand and improve as a result of COVID-19. The necessity of forecasting will start to open many finance teams’ eyes to what they need in a forecasting tool.

A high priority will be using technology to automate as many manual operations as possible. This will allow businesses to respond faster to future economic changes, but also free up valuable time. Finance teams can spend less time collecting data and more time responding to what their data is indicating.

Moving to cloud-based FP&A solutions will help make forecasting faster and easier in the future. Once teams embrace this change, they should then permanently incorporate these improvements into their entire planning process.

Taking actuals and using them as the basis for planning and making assumptions gives teams deeper insights. One of the benefits of Limelight is the ability to analyze data right away. Instead of gathering data for an entire year in order to even start on a forecast, everything is set up for you in Limelight. Teams can go in at any time and work with the data, rather than spend time consolidating data that could be from multiple different sources.

Make financial forecasting a long-term practice

Organizations need to equip themselves with facts and figures to be able to make decisions quickly and intelligently.

By modeling forecasting scenarios it allows businesses to find the answers they need. Companies can overcome common challenges through automation and integration found in software such as Limelight. External resources can be brought in to provide a more in-depth overview. Forecasts should update dynamically to always provide teams with up-to-date information and allow for better planning.

Once businesses gain a better grasp of their forecasting abilities, they should work to improve and implement these better practices to keep them up and running during any potential crisis. When the pandemic is over, businesses will now have a better method to manage their operations and lead their team into the future.

To see Limelight in action, watch our webinar where we demonstrate faster financial forecasting in the face of a crisis.