Can you perform FP&A with Power BI? Can Microsoft Power BI forecasting and budgeting serve as a substitute for dedicated FP&A solutions? These are questions we often get from our Microsoft Dynamics and other ERP Customers.

The Short Answer Is No

Typically, businesses will turn to cloud Financial Planning and Analysis (FP&A) software for their budgeting and forecasting needs.

To understand why, first we must know the capabilities of both Power BI desktop, which is a Business Intelligence (BI) tool and FP&A software, such as Limelight.

This begs the age-old question - what is the difference between BI and FP&A?

What Is Business Intelligence?

The term business intelligence was coined in 1989 as an umbrella term to describe methods used to improve business decision-making through facet-based support systems. BI is a set of tools focused on information delivery and is typically driven by the IT department. It is used for general-purpose reporting and analysis across the enterprise.

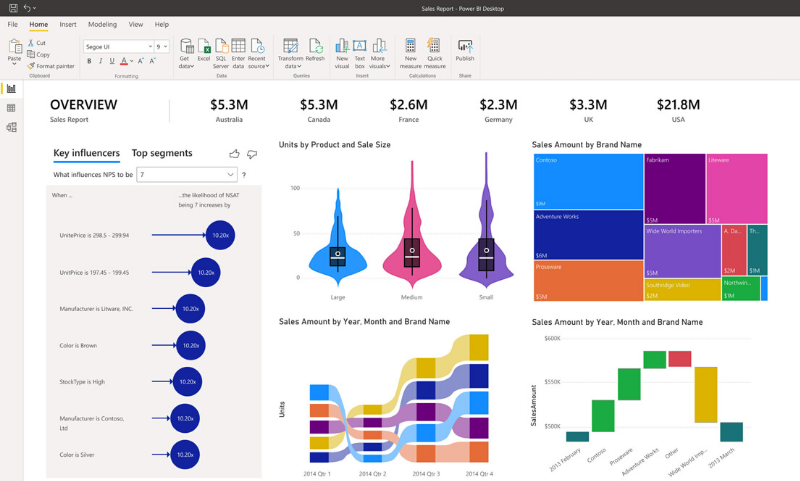

Business Intelligence products like Power BI, Tableau, QlikView and Domo are Data Visualization tools. These business analytics applications provide interactive visualizations with self-service business intelligence capabilities, where end-users can create reports and dashboards by themselves, without having to depend on IT staff or database administrators. For instance, the analytics pane in Power BI Desktop allows you to add dynamic reference lines to visuals and focus in on key trends or insights.

Where Business Intelligence tools fall short however, is in explaining the reason behind the data they are depicting. “It doesn’t tell you what to do,” said Michael F. Gorman, Professor of Operations Management and Decision Science at the University of Dayton to CIO Magazine. “It tells you what was and what is.”

Essentially, BI tools are descriptive - they may describe a current or past state, but they are not designed to help users discover the reason behind their numbers and perform deeper analysis beyond visualizations. BI products do not help to gather or consolidate data, especially for budgeting, planning, and forecasting. Power BI financial modeling, for instance, carries with it a number of challenges. Visualizations in Power BI like line charts and line graphs are helpful at presenting data points, but it's not adept at performing in-depth FP&A activities.

BI uses advanced analytics to find trends in your data. The platform allows the user to investigate data through exploration and drill down features. However, the BI solution does not offer a way to pinpoint what you should look for, and which datasets will drive business goals. Put succinctly, FP&A Power BI simply isn't your most efficient option. Power BI forecasting is an inefficient and incomplete way to perform forecasting activities.

Instead, companies turn to a different type of tool for data gathering, consolidating and analysis - FP&A software. If you want a forecasting line that more accurately and fully predicts future trends and developments, you'll need a dedicated tool.

What Is Cloud FP&A?

.png?width=800&name=Blog%20Post%20Inline%20Image%20(1).png)

Cloud FP&A evolved from Corporate Performance Management (CPM), also known as Enterprise Performance Management (EPM). Gartner details it as “an umbrella term that describes the methodologies, metrics, processes and systems used to monitor and manage the business performance of an enterprise.” The term CPM originated around 2001 to include not only aspects of BI but also financial applications, such as planning, reporting and consolidation. Gartner now refers to the next evolution of this software as Cloud FP&A.

This software takes your business information to the next level by monitoring and tracking the progress of your business based on historical data, planned and forecasted information, and actual results. So, rather than reporting on the here and now, which is what most BI systems do, the right FP&A software analyzes not only how your business has performed but also how it is currently performing and how it is likely to perform in the future. Forecasting options are greatly enhanced by cloud FP&A software.

Cloud FP&A systems can help manage performance by analyzing data from across the business against a defined set of KPIs to better plan and forecast the strategic direction of your company.

Designed for accounting and finance processes, FP&A software drills down into financial and operational analysis, linking key financial data to specific objectives and monitoring performance and highlighting where potential risks might lie. FP&A software puts data into context, explaining what the facts mean for the future of the business, and presenting an accurate picture of today’s business performance alongside a future forecast. For business leaders, this level of insight into future performance is crucial to driving business growth. Your forecast length and accuracy (as well as seasonal factors and other variables) will be much improved with dedicated FP&A solutions. Your confidence interval can be higher with more sophisticated FP&A tools that allow for more accurate time series forecasting and other more involved FP&A activities.

After defining KPIs and performance metrics specific to your business, Cloud FP&A software then helps executives see how close or far away the company is to achieving those goals. Budgeting, planning, and forecasting features are built into the software to help create a timeline for reaching organizational goals. These features include everything from modeling and planning to financial consolidations, to reporting and analytics. These built-in features are distinct from BI software, but metrics and KPIs displayed by FP&A software can look like BI tools.

Why Power BI FP&A Is Difficult

To analyze data, businesses need real-time financial information from their ERP or other source systems. This enables a single approach to all aspects of planning, whether it be sales forecasting, operational budgets, cashflow, or workforce and asset planning. The more time spent on consolidating data and creating reports, the less time businesses have for analysis. This area is where FP&A Microsoft Power BI falls short since data entry into the program can be difficult.

Finance professionals run into trouble when performing budget analysis in Power BI because of the different granularities of their data, modeling and input.

The question should then become - is it worth spending valuable time and resources on learning how to maneuver budgeting and planning processes into Microsoft Power BI? Shouldn’t the platform work for the business and not the other way around?

With Limelight, businesses can easily budget and forecast using data directly from Microsoft Dynamics, just like with Microsoft Power BI. Finance teams get the best of both worlds: native integration with their data system and an easy-to-use financial planning platform.

To learn more use cases for BI and Cloud FP&A, watch our on-demand fireside with Limelight’s CTO Jade Cole.

Don't Struggle With FP&A Power BI - Work with a Leading FP&A Software Instead

Using a wrench to hammer in a nail would be a misuse of your time and resources. Using Power BI FP&A is a similarly wrong approach - you're not using the right tool for the job. Forecasting in Power BI, in other words, is using the wrong tool for the job.

Our FP&A software was built from the ground up to ensure your organization can get all its budgeting, forecasting, planning, and analysis tasks completed faster - and more accurately - than ever.

With Limelight you will save thousands of hours and uncover hundreds of thousands in hidden costs via in-depth forecasting models, reduce budget reviews, and increase productivity by reclaiming your time.

Book a demo to see the platform in action and learn how it can help drive your growth at your organization by eliminating needless waste during the FP&A process and providing critical, data-backed insights on your finances.