Most organizations have a general idea of the key drivers of growth in their business. But how many are prepared for fluctuating markets or a dramatic increase in expenses? Without data to back up decisions, it can be difficult to determine the best course of action.

That’s where driver-based planning comes in. Organizations can use drivers to budget faster, gain greater visibility into the business and forecast strategically to mitigate risk. However, many finance teams use spreadsheets for their planning without being fully aware of their inherent limitations. There are broken links, formula errors, data integrity and security issues abound in spreadsheets, so if you are doing serious planning, it is worth evaluating some of the other tools that are available.

With an automated FP&A solution, you can use driver-based planning to its full potential and gain context behind your budgets and forecasts. Read on to learn the benefits of driver-based planning and how your finance team can accelerate growth and profitability in your company.

What is Driver-Based Planning?

Driver-based planning is a budgetary method used to make decisions when forming the annual budget and rolling forecasts. The goal is to plan activities that drive business performance by focusing on controllable variables.

Driver-based planning is mainly based on linking the business’ finance-related and non-finance-related activities. The most popular driver-based planning is when variable costs are involved such as:

- Employee costs: based on the number of hours an employee works, the budget can be adapted by simply changing the number of hours worked multiplied by the hourly cost, thus updating the total employee cost

- COGS (Cost of Goods Sold): same logic as above except the variable susceptible to change is the price of raw products

An FP&A solution can update these variables quickly and accurately, allowing managerial decisions to be made faster. This type of planning also eliminates hit-and-miss practices, as the cause-and-effect relationship is already established when linking drivers to financial outcomes.

What are the Main Benefits of Driver-Based Planning?

Identifying the organization’s main operational drivers or activities enables financial forecasts to be made with more confidence. Better decision-making results from better alignment of decision-makers across the business.

Companies use driver-based planning to:

- Control the outcomes and different scenarios prone to occur

- Increase efficiency for financial planning and analysis

- Have the versatility to adapt in case of change

- Quickly and accurately revise business strategies

- Reduce the risk for error as the drivers are linked to the related general ledger account or financial statement line items (FSLI’s)

How Can I Use Driver-Based Planning to Improve My FP&A Process?

Using this budgetary method, finance teams can accelerate their planning process in three main areas: improved collaboration, flexibility, and visibility into potential outcomes.

Unify financial and operational data

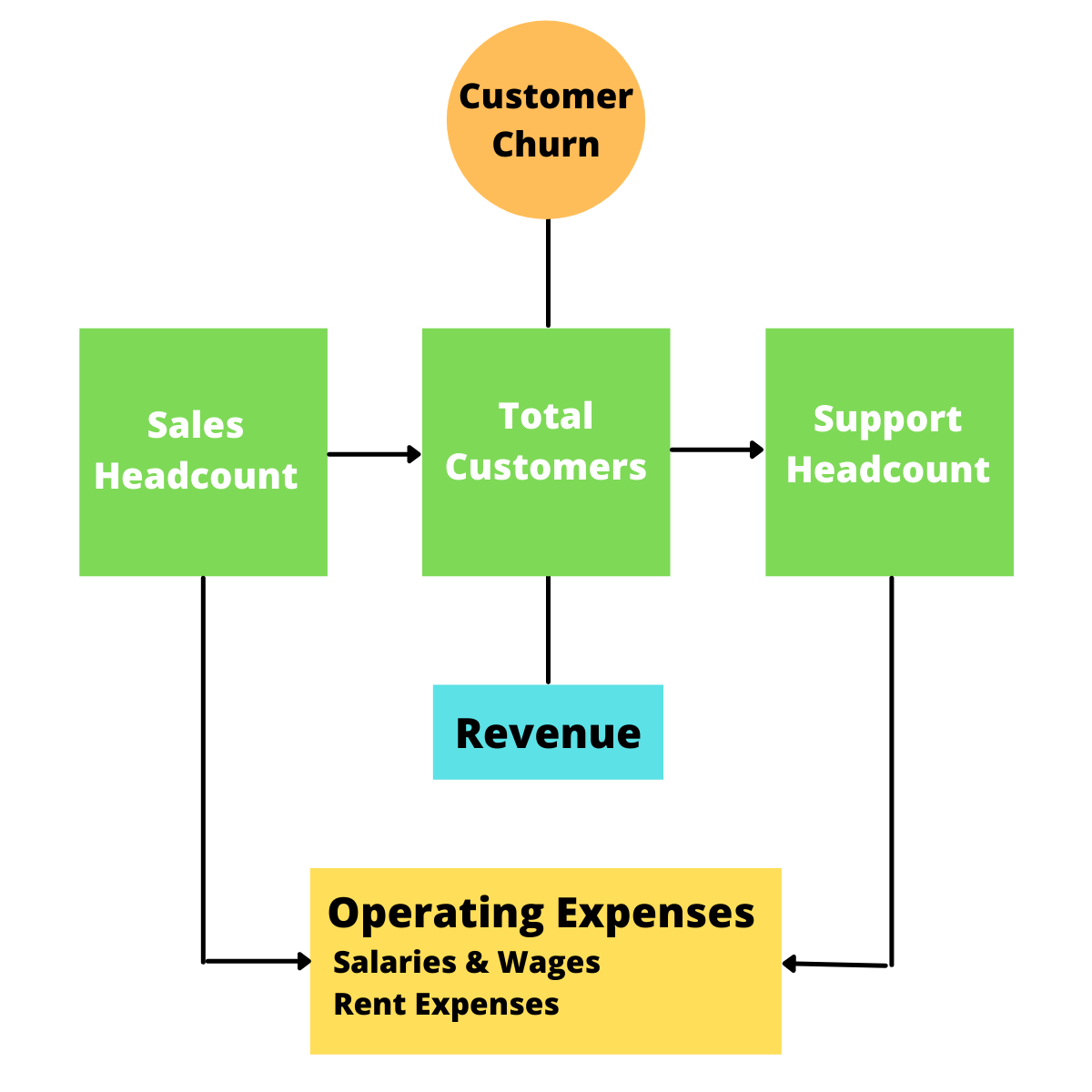

Driver-based planning can be used to show a direct link between financials and operational data. As an example, companies often keep an eye on customer churn to see how it will affect their bottom line. In the example below, we can see that the total number of customers is part of a cycle affecting sales headcount, support headcount, operating expenses and revenue. Using driver-based planning, each of these variables can be adjusted to show the impact on the rest of the cycle, helping executives make better-informed decisions.

Easily adjust forecasts based on market fluctuations

Companies performing What-If analysis can better predict and prepare for potential outcomes. Driver-based planning makes What-If analysis easier by showing the impact of financial decisions on other areas of the business. If managers want to know what happens when costs increase, they can build scenarios where they test price changes and see the overall effect on the budget.

Provide clarity on where the business is headed

Driver-based planning allows teams to forecast and reforecast throughout the fiscal year, leading to better adaptability to trends in the economy. Finance professionals can precisely plan revenue and expenses to make effective decisions such as hiring more staff, downsizing office space and increasing production output. Teams also have the advantage of knowing when finances are healthy and having the confidence that the business can sustain new projects.

What are the Key Factors I Need to Set Up Driver-Based Planning?

- Collaboration on key business drivers

Getting organizational alignment is typically the biggest hurdle when setting up driver-based planning. Each team member will need to understand their role and what they are accountable for in the process. With Cloud FP&A software, employees can execute tasks in the same system without interrupting one another. This is unlike Excel, where collaborative planning is difficult because of broken links and many document versions. Once the drivers’ logic has been set up, the planning process becomes faster and simpler as drivers are centralized in one place and can be easily modified. - Integration with source systems

To get the most value from driver-based planning you will need an integrated platform. Cloud FP&A software can derive data directly from your ERP system to keep the source’s mapping and data integrity. Actual values are then routed to the appropriate financial statement and can also be used as a baseline for the upcoming budgeting period. - Real-time access to data

The timeliness of your data is critical when making strategic decisions. Direct integration to your ERP system allows fast and reliable access to data, meaning your team will always work with accurate numbers. Instead of waiting until the month-end close to enter data, the integration delivers a continuous source of actuals that all finance professionals can use for reporting.

Better Driver-Based Planning with Modern Cloud FP&A Platforms

Driver-based planning accelerates the budgeting and forecasting process using accurate data available in real-time. Using business drivers to back decisions helps your company sustain growth by providing the ability to rapidly re-forecast and re-engineer the current situation with minimal effort.

While spreadsheets are the tool of choice, they are prone to errors and often take hours or even days to update manually. A financial model that allows for adjustments of key drivers can take days to build in a spreadsheet. Modern cloud FP&A software offers Excel-like features and formulas, making the learning curve short for finance professionals. To get the most out of driver-based planning, companies need a collaborative, integrated platform that delivers immediate access to critical business information.

To see an in-depth video on building a driver-based planning model in a Cloud FP&A solution, watch our video on How to Set Up Driver-Based Budgeting.